- Finance Latte Newsletter

- Posts

- Time in The Market vs. Timing The Market

Time in The Market vs. Timing The Market

December 18, 2023

Happy Monday!

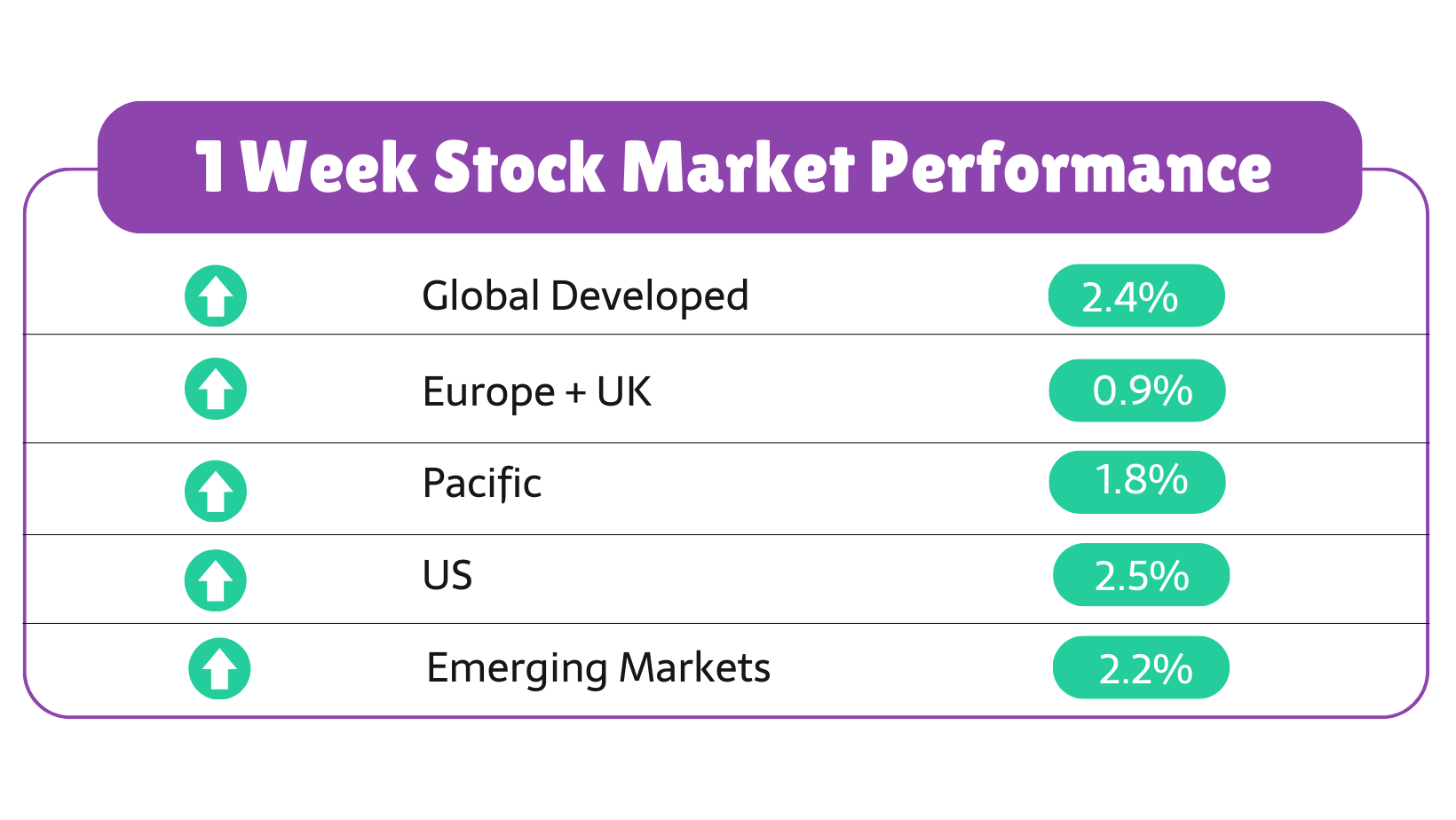

Global stock markets rallied 2.5% last week after the US central bank said they expect 3 interest rate cuts in 2024. (Phew, that's a welcome sigh of relief for anyone with debt.) This brings the total performance for the year to 25%!

If you missed the rally because you were sitting in cash waiting for a better "entry point," remember what Warren Buffet says: "TIME IN the market is better than TIMING the market." He knows that well. After all, 99% of his wealth was created after his 50th birthday.

With Warren's wise words, we want to wish everyone a wonderful holiday season as we take a break and resume our newsletter on January 8th. May you rest, self-reflect and recharge for a killer 2024!

And if you want to nail those New Years Resolutions before you even wrote them down, join us for the Investor Accelerator Course starting on January 8th! We already have a cozy group ready to master their investing skills and grow their confidence in managing their wealth. Use the 50% discount code (EARLYBIRD50) before January 1st.

– Margarita T., CFA.

MARKETS

Lower Interest Rates in 2024. Whoop!

Source: Morningstar, MarketWatch. Data as of December 15, 2023.

Indexes listed above are (in order): MSCI World Net (USD), STOXX Europe 600 (EUR), MSCI Pacific (USD), S&P 500 (USD), MSCI Emerging Markets IMI Net (USD).

Economics - 4 Central Banks Kept Rates on Hold.